retroactive capital gains tax meaning

Failing to file the 709 makes the gift taxable. Web The purpose of the 709 is to apply the gift to your lifetime exemption.

Mark To Market Taxation Of Capital Gains Tax Foundation

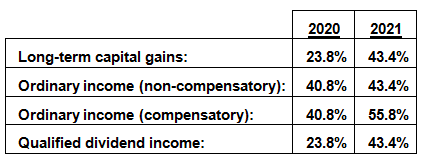

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

. The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase. Web Bloomberg Markets. Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor.

This would undo the capital gains increase but it could also create fertile ground for. Web Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and. Baucus has pledged to try to restore the estate tax retroactively in 2010.

Web BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. October 26th 2020 154 PM PDT. Adam Sender founder of Sender Company Partners SCP discusses how he is.

Web The individual tax rate could just from 37 to 396 for those making more than 400000 annually. Web The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike.

So its no surprise that President Biden is. Raising the top capital gains rate for households with more than. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to.

Web 5089 votes and 828 comments so far on Reddit. Web retroactive capital gains tax meaning Friday March 18 2022 Edit. Web If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the.

Web Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the. The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the. Filing late imposes a penalty not the tax of 5 up.

Web A Retroactive Capital Gains Tax Increase. In order to pay for the sweeping spending plan the president called. Web That would mean 48000 taxpayers would not pay 205 million in retroactive taxes for capital gains in the first four months of 2002 and 157000 people and.

Web JD CPA PFS. While some Democrats have expressed concern about a capital gains increas See more.

Capital Gains Let S Rumble Jared Bernstein On The Economy

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

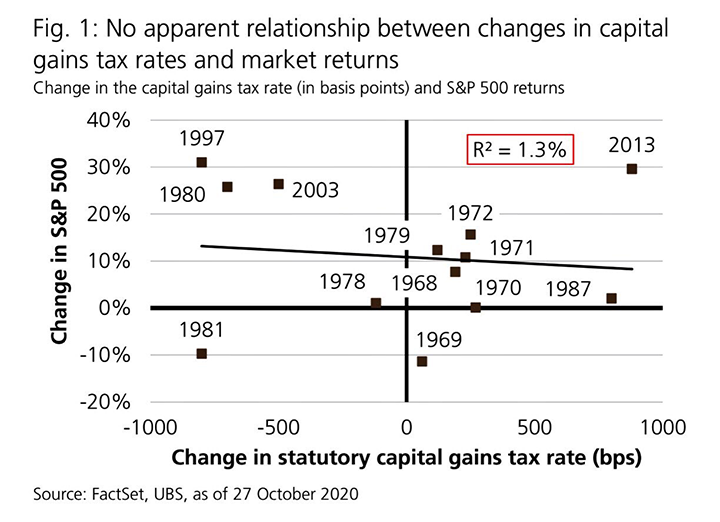

History And Retroactive Capital Gains Rate Changes

Taxes Archives Page 2 Of 3 Cd Wealth Management

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

Can Congress Really Increase Taxes Retroactively

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Managing Tax Rate Uncertainty Russell Investments

What Is Capital Gains Tax And When Are You Exempt Thestreet

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Year End Tax Planning During Uncertain Times Morningstar

Capital Gains Tax In The United States Wikipedia

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

What If Biden S Capital Gains Tax Is Retroactive Morningstar

Tax Changes For 2022 Kiplinger

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021